Expertise

- User Experience Design

Client:

Flender

Industry

Bringing Flender to new audiences

Flender aspires to make it possible for businesses and consumers to lend and borrow money by linking in with social network connections. There are no lenders’ fees attached, unlike most platforms, but there is a success fee and what the company calls “a small interest margin”. They faced a challenge. The global peer-to-peer lending (P2P) market has grown steadily since 2005, and over $50bn is lent every year. Flender had an ambitious vision to be part of this disruption of the banking industry, however, with a partially built platform, they needed help to bring their dream to reality.

The strategy

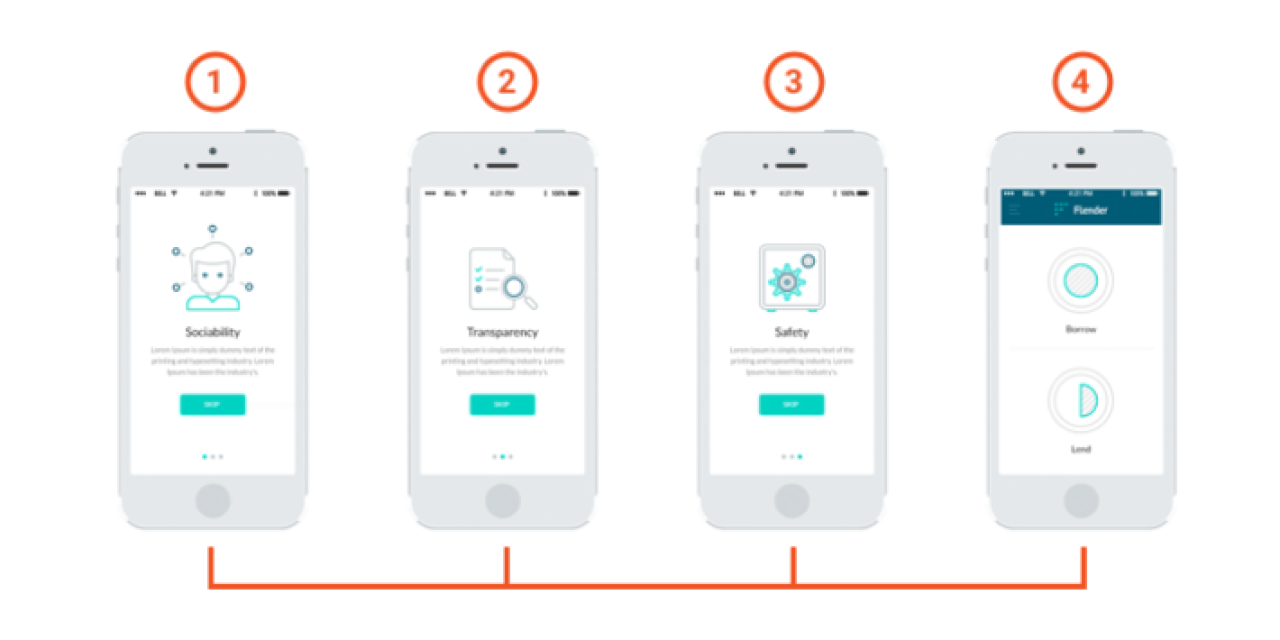

Flender sought our expertise to design a user-centric digital experience. We conducted workshops and extensive research on lending psychology, peer-to-peer borrowing, crowdfunding, and community projects. This early insight guided the creation of a persuasion roadmap for the app's interface, focusing on buyer and lender needs.

To validate initial assumptions, we performed 12 remote usability tests across competitor platforms, refining user journeys based on participant insights. Analysis of these tests informed adjustments to prioritize borrower and lender experiences.

Tailored notifications, email triggers, and content were developed to align with users' mental models, ensuring clear information delivery while guiding users through the setup process effectively.

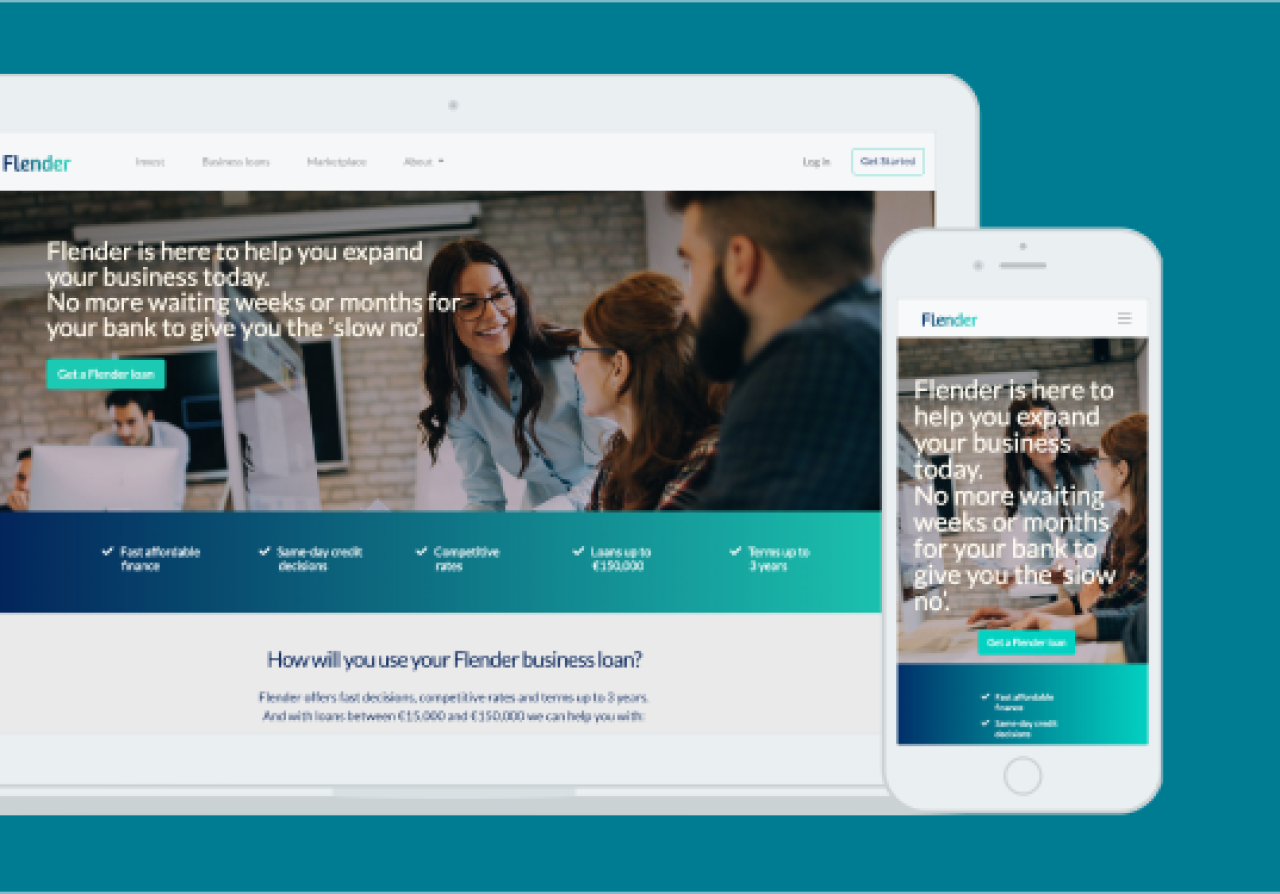

The solution

The Logic+Magic UX team delivered a suite of annotated wireframes to illustrate all screens for the borrower and lender journeys. The design prioritised clarity and the importance of story – for the borrower in terms of how they could track their funding journey, and for the lender in how they connected with the borrowers’ narratives.

The best thing we did was to outsource the UX design. We only wish we had done it sooner... The end result was great.

The impact

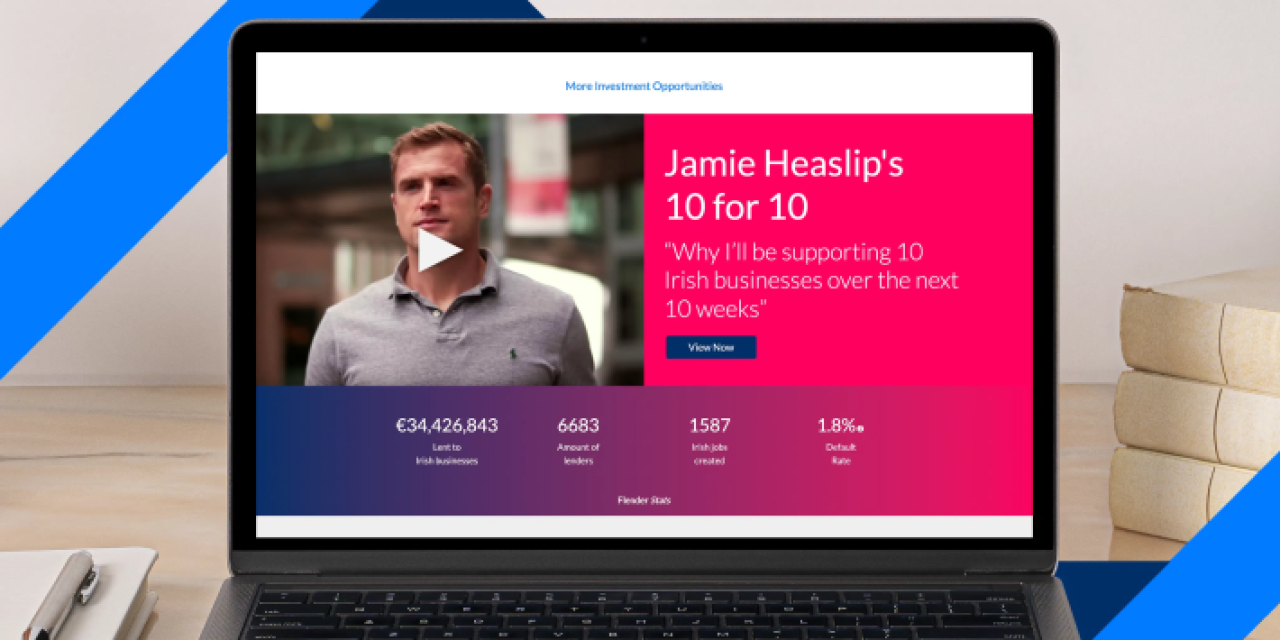

Our tailored usability tests refined user journeys, while bespoke content ensured clear guidance, enhancing the platform's user-friendliness and effectiveness. The improved site launched in March 2017 and since then Flender has experienced phenomenal growth.

Sales went from zero to nearly €3m in September 2018.

225 new jobs created

Average interest returned to lenders of 10.3%